Last Updated on 19 августа, 2025 by Ideal Editor

📈 Türkiye 2025 FDI Surge Powers Property: What the Surge Means for Real Estate

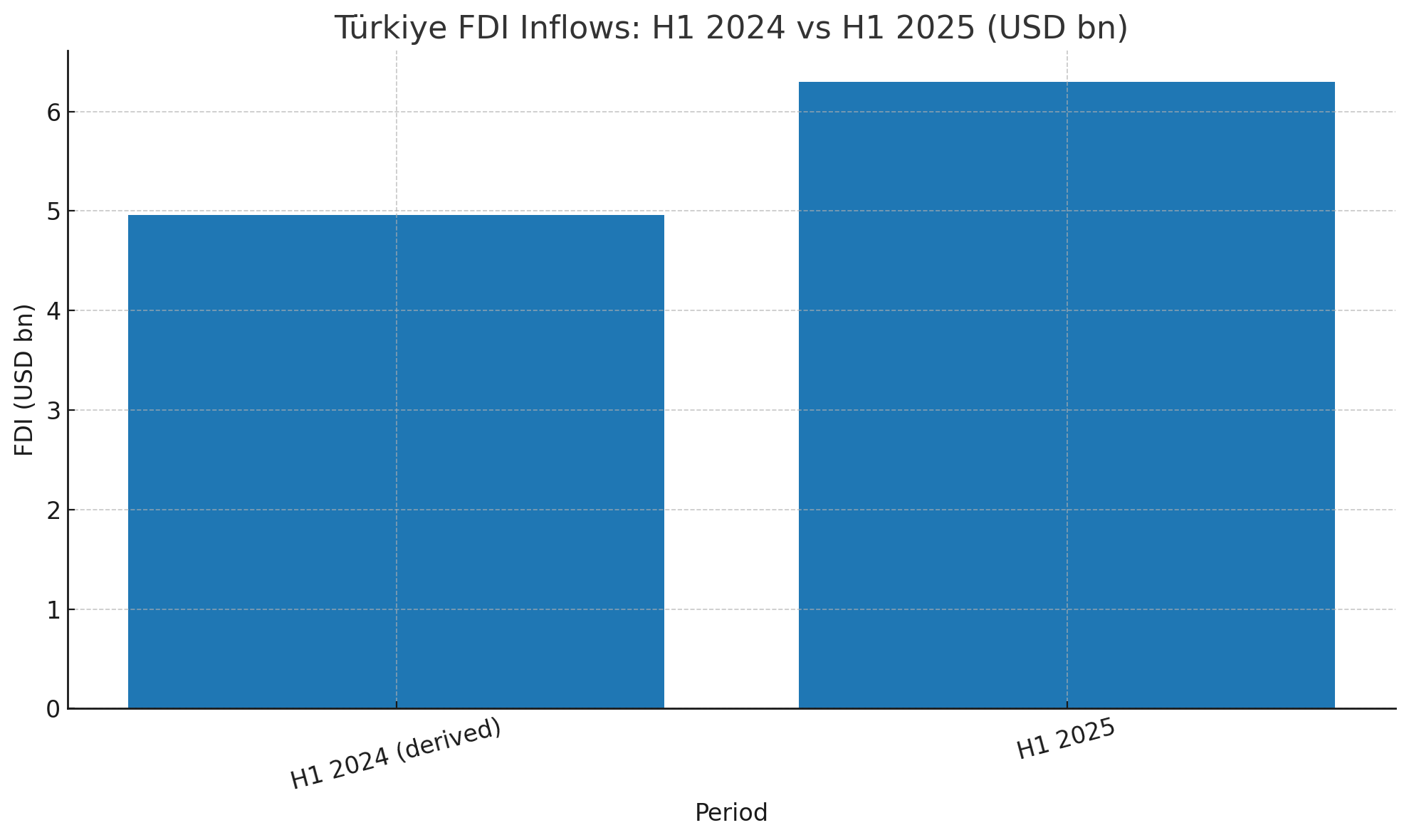

Türkiye’s foreign direct investment (FDI) inflows jumped 27.1% year over year to USD 6.3 billion in H1 2025, with annualized inflows at USD 13.1 billion—the highest level since May 2023. “Türkiye 2025 FDI Surge Powers Property” is more than a news headline; it’s a signal of confidence, capital depth, and future liquidity across cities and coastal markets.

Short version: when global companies commit capital to operations, supply chains, and services in Türkiye, high-skilled jobs follow. That brings relocations, executive housing demand, long-stay rentals, and a rising service economy—all direct tailwinds for residential and mixed-use real estate.

🔍 Key Numbers at a Glance

- 🧮 FDI, H1 2025: USD 6.3B (+27.1% YoY)

- 📊 Annualized (as of June 2025): USD 13.1B, the strongest since May 2023

- 🌍 Global context (2024): Worldwide FDI fell 11%, while Türkiye grew 10.2% to USD 11.7B

- 🧭 Top investor countries (H1 2025): Netherlands, Kazakhstan, United States, Germany, Azerbaijan, Switzerland, France, United Arab Emirates, United Kingdom, Austria

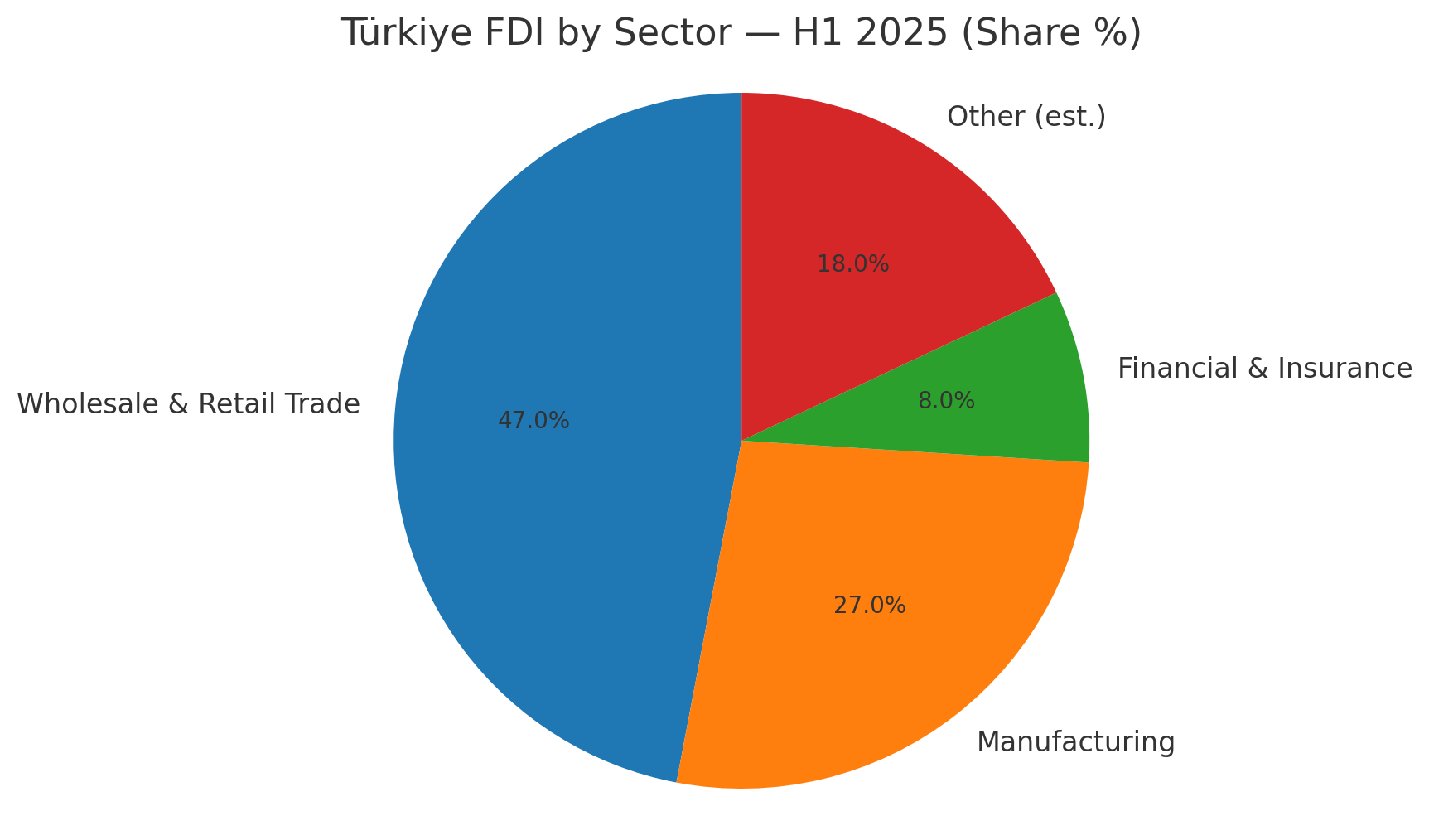

- 🏭 Sector shares (H1 2025): Wholesale & Retail 47%, Manufacturing 27%, Financial & Insurance 8%

🧭 Why It Matters for Property Buyers and Investors

FDI is one of the cleanest indicators of future-proof demand. It aligns with long-cycle themes—export capacity, logistics corridors, financial services, and consumer markets—that sustain 12-month rental demand and capital appreciation.

- Jobs & Relocations → Housing Needs: Multinationals bring managers, engineers, and specialists—a pool that pays for quality rentals in prime and near-prime neighborhoods.

- Supply Chain Investment → Infrastructure Upgrades: Manufacturing and logistics FDI typically accelerates roads, ports, airports, utilities—improving commute times and broadening the map of investable districts.

- Retail & Services → Mixed-Use Vitality: With wholesale/retail at 47% of FDI, ground floors thrive (cafés, clinics, co-working), which supports upper-floor residential values and short-stay occupancy.

- Fin/Insurance → Corporate Stays: The 8% share into finance helps deepen international mobility (auditors, consultants, bankers), often preferring turnkey, professionally managed apartments.

The Macro Signal: Confidence in Türkiye’s Fundamentals

Despite a global FDI drop of 11% in 2024, Türkiye rose 10.2% to USD 11.7B, then accelerated again in H1 2025. For real estate, this divergence matters: it suggests policy credibility, strategic location advantages, and integration into global value chains—all factors that reduce the risk of buying into a “tourism-only” cycle and strengthen the case for year-round, yield-bearing assets.

What the Country Mix Tells Us

Top capital sources in H1 2025: Netherlands (No. 1), followed by Kazakhstan and the United States, then Germany, Azerbaijan, Switzerland, France, UAE, UK, Austria. This breadth shows diversified investor appetite across EU, Central Asia, North America, and the Gulf—reducing concentration risk and boosting cross-border corporate mobility that feeds executive rentals and expat housing clusters.

Tip: Properties near business parks, free zones, or transport hubs often see stickier occupancy from expats and corporate clients.

Sector Deep-Dive: Where Capital Is Flowing

🛍️ Wholesale & Retail (47%)

- Why it’s important: Retail/wholesale investment signals consumption power and distribution build-out.

- Real estate angle: Think mixed-use: residential buildings above high-street retail, short-stay apartments near shopping axes, and serviced units for visiting staff.

- What to prioritize: Walkable, amenity-rich streets; energy-efficient new-builds to reduce monthly carrying costs.

🏭 Manufacturing (27%)

- Why it’s important: Factory and advanced manufacturing expansions create stable payrolls and housing demand beyond the summer season.

- Real estate angle: Look at commuter belts with improving highways and reliable public transport—larger 2+1 and 3+1 units suit families relocating for work.

🧾 Financial & Insurance (8%)

- Why it’s important: A deeper financial ecosystem draws consultants, auditors, and regional teams—the classic corporate-stay audience.

- Real estate angle: City-center and near-center apartments with professional management, secure entries, and quiet workspaces (co-working or studies) win here.

From Macro to Micro: Turning FDI into Property Strategy

1) Choose Locations that Benefit from Corporate Mobility 🧳

- Near business districts / free zones / logistics nodes

- Access to airports and main arteries for executive commutes

- Neighborhood services: international schools, clinics, fitness, co-working

2) Buy for Year-Round Utility, Not Just Summer ☀️➡️📅

- Larger 2+1 or 3+1 units work for families on long contracts.

- City and near-prime districts beat seasonal-only tourist pockets on occupancy stability.

3) Amenities and Building Quality Matter 🧱

- Modern insulation, elevators, parking, security, EV charging, reliable internet.

- Earthquake-code compliant new builds and documented renovations protect long-term value.

4) Strong Management = Stronger Yields 🛎️

- Professional tenant screening, furnishing standards, and permit-compliant short stays (where allowed) unlock better ADRs and reviews.

Ideal Estates Market Playbook (Actionable, Data-Led)

We translate macro FDI momentum into property returns through a disciplined, numbers-first approach:

- 🧭 Investor Briefing → Area Match

- 📊 Comparable Sales & Rental Benchmarks

- 🧩 Product-Market Fit

- 🛠️ Technical & Legal Diligence

- 🏡 Hands-on Asset Setup

- 📈 Performance Cadence

How Türkiye 2025 FDI Surge Powers Property Should Guide Your Next Purchase

- Resilient yield: Target business-served, transit-accessible districts.

- Capital growth: Favor supply-constrained micro-markets with infrastructure upgrades.

- Lifestyle + income: Look for walkable areas with schools/healthcare.

- Portfolio growth: Diversify across city-core and commuter belts.

Country Inflows: What Each Cohort May Seek

- Europe (Netherlands, Switzerland, France, UK, Austria): Codes-compliant, energy-efficient new builds, quiet urban locations.

- Central Asia (Kazakhstan, Azerbaijan): Family-sized layouts and villa-style privacy near schools.

- US & Gulf (United States, UAE): Turnkey city apartments, prime locations, professional management.

Mobile-First Summary (Skim in 30 Seconds)

- ✅ Momentum confirmed: H1 2025 FDI up 27.1% to USD 6.3B

- 🔧 Real estate impact: Jobs, relocations, stronger rental base

- 🛍️ Sector tailwinds: Retail (47%), Manufacturing (27%), Finance (8%)

- 🌍 Investor breadth: EU + Central Asia + US + Gulf

- 🧭 What to buy: Transit-accessible, code-compliant builds, professionally managed

WHY PARTNER WITH IDEAL ESTATES

- 🧠 Strategy, not guesswork

- 🧾 Full-scope diligence

- 🤝 Trusted local network

- 📍 Area intelligence

- 📈 Performance obsession

Ready to convert Türkiye’s FDI momentum into property performance?

👉 Book a strategy call with Ideal Estates for a data-backed shortlist tailored to your yield or lifestyle goals.

Prefer to browse first? Ask for our area briefs, request an FDI-to-Real-Estate cheat sheet, or subscribe for updates.

FAQs About Türkiye 2025 FDI Surge Powers Property

1) How does the FDI surge translate into property returns?

More FDI means more jobs and relocations, which broadens rental demand and supports long-term value.

2) Which property types benefit most from current sector flows?

With retail/wholesale and manufacturing leading, look at city and near-prime apartments, family-sized units, and professionally managed rentals.

3) Do investor-country trends affect neighborhood choice?

Yes. The EU, Central Asia, US, and Gulf mix implies diverse tenant profiles—guiding layout, amenity, and location choices.

4) Is the momentum likely to persist?

The annualized USD 13.1B (highest since May 2023) indicates a positive trajectory subject to macro conditions and reforms.

5) How does Ideal Estates reduce risk for foreign buyers?

By insisting on code-compliant builds, rigorous title/developer checks, and permit-aligned letting strategies, then managing pricing and exit timing.

Note: Figures and rankings refer to H1 2025 data and context as published on August 12, 2025.